**France Advances Unproductive Wealth Tax Amendment Targeting High-Value Crypto Holdings**

On October 22, French lawmakers voted 163-150 to advance a controversial tax amendment that expands the scope of the country’s real estate wealth tax to include digital assets such as cryptocurrencies. The measure, backed by centrist, socialist, and far-right MPs, redefines “unproductive wealth” to cover not only real estate but also items like gold, art, planes, and notably, crypto holdings.

—

### What Is France’s Unproductive Wealth Tax on Crypto?

The French National Assembly passed an amendment filed by Centrist MP Jean-Paul Matteï that broadens the existing real estate wealth tax framework. This amendment targets so-called “unproductive goods”—assets that do not directly contribute to economic productivity, including cryptocurrencies like Bitcoin and Ethereum.

Previously, digital assets were exempt from this tax, classified as unproductive goods outside the tax’s jurisdiction. The new legislation seeks to bring these assets under fiscal scrutiny, targeting large holdings as part of a policy shift aimed at encouraging investment in productive sectors of the economy.

The amendment passed with a narrow majority of 163-150 votes but still requires approval by the Senate to become law, anticipated for the 2026 budget cycle.

—

### How Does the Amendment Affect Crypto Holders?

Under the revised tax rules, individuals with unproductive wealth exceeding €2 million (approximately $2.3 million) will owe a flat 1% tax on the amount above that threshold. This is a significant change from the current structure, which has a lower threshold of €1.3 million and a progressive rate ascending up to 1.5% for assets over €10 million.

Importantly, the taxable assets now explicitly include “digital assets” that are not actively contributing to the real economy—such as cryptocurrencies held passively, not staked or traded within economic ventures.

—

### Reactions From the Crypto Community

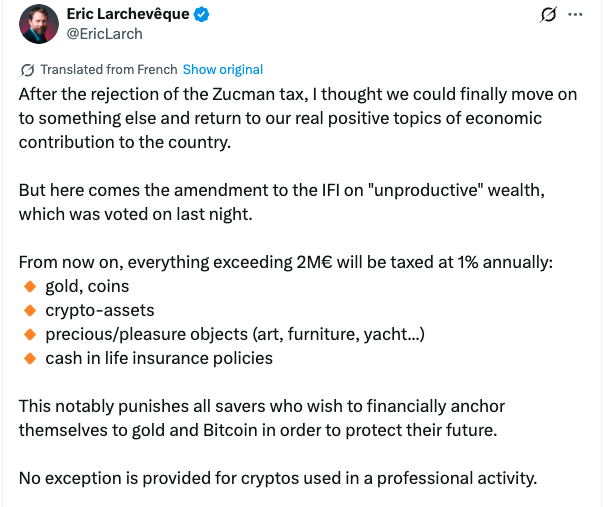

Éric Larchevêque, co-founder of the crypto wallet provider Ledger, criticized the amendment, stating:

*”This punishes all savers who wish to financially anchor themselves to gold and Bitcoin in order to protect their future.”*

He expressed concern that the law equates crypto to an “unproductive reserve,” detached from productive economic activity—a stance he described as a major ideological error. Larchevêque also warned that crypto holders might be forced to liquidate assets to cover tax liabilities if they lack sufficient liquidity elsewhere. Additionally, he fears the €2 million threshold may be lowered in future legislative sessions.

—

### Who Will Be Impacted?

Data from French tax authorities indicate that although only a small percentage of people hold assets of this magnitude, including crypto could affect thousands of high-net-worth individuals. Financial analysts estimate that up to 50,000 people might fall under this tax bracket based on 2024 wealth distribution reports.

The increased threshold from €1.3 million to €2 million may alleviate tax burdens on mid-tier holders while concentrating levies on ultra-wealthy portfolios. However, experts such as those from the French Banking Federation caution this could drive capital flight to more crypto-friendly jurisdictions within the European Union.

—

### Frequently Asked Questions

**What Threshold Triggers the France Unproductive Wealth Tax on Crypto?**

The tax applies to unproductive wealth — including cryptocurrencies — exceeding €2 million. Only the value above this threshold is subject to a flat 1% tax rate.

**Will This Crypto Tax Amendment Become Law in 2026?**

While approved by the National Assembly, the amendment must still pass the Senate and be incorporated into the 2026 budget. Given current parliamentary support, a January 1, 2026 implementation is considered likely.

**How Does This Differ from Existing Crypto Taxes in France?**

Existing crypto taxation in France targets capital gains with a 30% rate on transactions. This new wealth tax focuses on the value of holdings themselves, aligning with broader EU discussions on regulating digital assets comprehensively.

**What Assets Are Considered Unproductive Wealth?**

Besides digital assets, unproductive wealth includes non-productive real estate, precious objects, planes, art, gold, yachts, classic cars, and similar luxury goods.

—

### Key Takeaways

– **Tax Expansion Targets High-Value Assets:** Only crypto holdings exceeding €2 million will be taxed at a flat 1%, aiming to shift capital toward productive economic activities.

– **Legislative Process Continues:** With Senate approval pending, the amendment’s final status depends on upcoming budget negotiations.

– **Investor Concerns Grow:** Market participants are advised to monitor developments and diversify portfolios to mitigate risks from forced asset sales.

—

### Conclusion

France’s unproductive wealth tax amendment marks a significant development in the country’s approach to cryptocurrency taxation. By incorporating digital assets into the unproductive wealth category, the government aims to close fiscal loopholes and promote economic dynamism through targeted taxation.

Though the tax ultimately only affects a fraction of crypto holders, critics, including leading figures in the sector, warn that classifying crypto as unproductive could disincentivize long-term savings and harm France’s competitiveness in the digital asset space.

As the measure proceeds through the Senate, investors should remain vigilant, seek professional tax advice, and consider compliant strategies to navigate the evolving regulatory environment set to take effect in 2026.

—

*Stay informed about developments in crypto taxation and financial regulations in France to protect your assets and optimize your investment strategies.*

https://bitcoinethereumnews.com/bitcoin/france-advances-crypto-tax-amendment-targeting-bitcoin-as-unproductive-wealth/?utm_source=rss&utm_medium=rss&utm_campaign=france-advances-crypto-tax-amendment-targeting-bitcoin-as-unproductive-wealth