**Key Facts: When Could Trump’s Tariffs Get Overturned?**

It’s unclear. The Supreme Court typically takes at least several months to issue rulings after it hears oral arguments. However, the justices’ decision to swiftly take up the tariff case makes it uncertain if they’ll try to rule more quickly here. Any decision will come out by June 2026 at the latest, when the Supreme Court’s term comes to an end.

—

### Potential Tariff Winner: Electronics Industry

Electronics are one of the biggest categories of imports into the U.S., according to the U.S. International Trade Commission. The high volume of goods being imported, coupled with their higher price points, means the sector could particularly benefit if the tariffs are overturned.

Brian Riley, Senior Vice President of Customs House Brokerage at logistics company GEODIS, told Forbes that electronics companies are expected “to be among the most impacted and the ones that stand to gain the most” from a ruling against the tariffs. He predicted these businesses could receive “an immediate windfall of cash” if the Supreme Court requires the federal government to automatically refund importers’ duties.

While there’s no clear data on which companies have imported the most since the “Liberation Day” tariffs took effect, previous data on the biggest U.S. importers from 2024 suggests that electronics companies like LG Group, Samsung, Electrolux, and Best Buy are among the largest electronics importers and could stand to make back the most if the tariffs are struck down. (LG Group told Forbes it is not commenting on tariffs, and other major importers did not respond to requests for comment.)

—

### Potential Tariff Winner: Retailers and Consumer Goods Companies

Trump’s “Liberation Day” tariffs have had a “significant impact” on the retail and consumer goods industry, which has long sourced goods primarily from Asia, Andrew Siciliano, Global Practice Leader at KPMG’s Trade & Customs division, told Forbes.

While many sectors might see tariffs reimposed if the Supreme Court strikes down the more sweeping tariffs, Siciliano predicted that retail and consumer goods could receive more of a “reprieve,” due to the wide variety of consumer goods making it harder to apply product or sector-specific tariffs on them.

Companies in this sector that imported the most goods into the U.S. in 2024 — and are likely to benefit from a favorable tariff ruling — include Walmart, Home Depot, Target, Lowe’s, Amazon, Dollar Tree, IKEA, Williams Sonoma, Ross, GE Appliances, and Dollar General, according to data analyzed by S&P Global.

—

### Here’s How Consumers Could Benefit if Tariffs Are Rolled Back

American consumers are increasingly bearing the brunt of the “Liberation Day” tariffs as they continue, Riley told Forbes, suggesting that a ruling in Trump’s favor could help stave off price increases as companies shift more of the tariff costs onto consumers.

“For many companies, [the tariffs] have passed the point where the cost can be simply absorbed,” Riley explained. “Many companies are no longer able to absorb the cost, which means it is increasingly being passed along to the consumer in some manner.”

Should companies receive refunds for tariffs they’ve paid, trade attorney Robert Shapiro speculated to Forbes that consumers might bring class-action lawsuits against major retailers seeking refunds for any price increases paid as a result of tariffs. However, it remains to be seen how that could play out.

—

### Investment Funds Could Profit Through Tariff Refund Rights

An unexpected winner in the tariff case could be investment funds. Wall Street firms are increasingly entering the tariff dispute by approaching importers and offering to buy their refund rights in exchange for approximately 20% to 30% of what companies have paid in tariffs.

These firms stand to gain financially if the Supreme Court overturns the tariffs and they collect full refunds for paid duties. The deals are expected to primarily benefit hedge funds handling alternative assets and litigation finance firms experienced in legal dispute investments. However, the secretive nature of these deals has kept much information under wraps.

—

### How Trump Can Impose Tariffs If These Are Overturned

Treasury Secretary Scott Bessent and other Trump officials have stated they will try to replace any IEEPA tariffs that get struck down using other legal statutes. Some laws explicitly allow the president to impose tariffs but with more restrictions, such as those allowing tariffs on specific sectors — a strategy Trump has already used for goods like automobiles and steel.

International trade attorney Patrick Childress told Forbes, “The U.S. Government has the authority it needs to try to recreate the IEEPA tariff regime if it chooses to do so,” though he noted the process would “take some time” to implement.

The Trump administration would likely “prioritize” key imports from major trading partners, meaning companies importing non-strategic goods from low-profile trading partners might avoid new tariffs for longer, Childress added.

—

### Would the U.S. Still Owe Refunds if They Eventually Impose Tariffs Again?

Probably yes, though the exact process remains unclear. The Trump administration could attempt to claim any new tariffs should apply retroactively. However, this is yet to be determined as the situation unfolds.

—

### What We Don’t Know

The Trump administration has suggested it would refund tariffs importers have paid if the policy is struck down — a key reason why a ruling against the duties could be so detrimental. However, it remains unclear how the refund process would actually work.

International trade attorney Clinton Yu told Forbes, “The truth is that we don’t know what the IEEPA refund process will look [like].” David Warrick, EVP at supply chain risk management company Overhaul, added that with no guidance from the government, companies have to “start planning for all scenarios” regarding the refunds.

“The tariffs may not be automatically refunded, it may be a lengthy process, it may be application-based for every single import,” Warrick noted. “We just don’t know.”

—

### Key Background

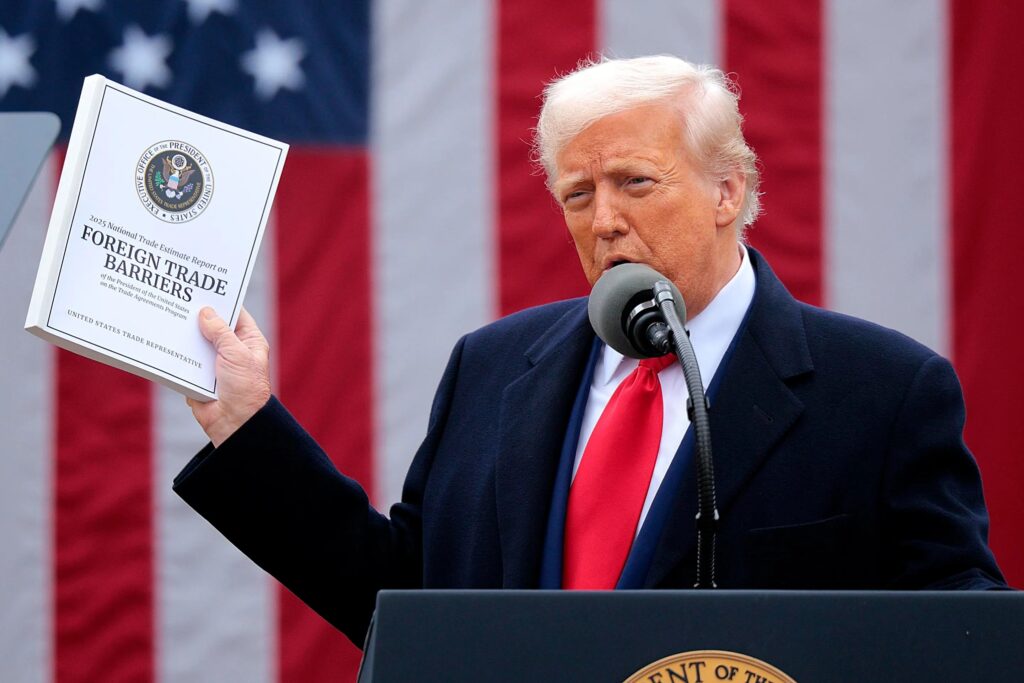

Trump imposed his “Liberation Day” tariffs in April after repeatedly promising sweeping tariffs during his campaign, despite warnings from economists that they would harm the economy and raise prices for consumers.

The tariffs only briefly took full effect in April before the worst of them were paused following stock market turmoil. The Trump administration then fully reinstated the policy in August.

The Supreme Court case centers on challenges brought by small businesses who have had to pay the increased tariffs and Democratic-led states. They argue that IEEPA — which allows presidents to impose some economic sanctions during national emergencies — does not give presidents the power to implement sweeping tariffs, especially when there is no emergency to justify them.

The Court of International Trade and Federal Circuit both agreed with the plaintiffs, finding Trump’s tariffs unlawful. However, the fees have remained in effect while litigation continues.

The tariffs have become a centerpiece of Trump’s economic agenda, and he and his top officials have repeatedly claimed that the Supreme Court case poses an existential threat to the administration.

—

### Crucial Quote

“I think our country will be immeasurably hurt. I think our economy will go to hell,” Trump told *60 Minutes* when asked about the possibility that the Supreme Court could invalidate his tariffs.

—

**Further Reading**

[Link to related articles and resources]

https://bitcoinethereumnews.com/finance/if-trumps-tariffs-are-overturned-these-companies-could-be-the-biggest-winners/