**Italian Banking Association Endorses Digital Euro as a Symbol of Sovereignty**

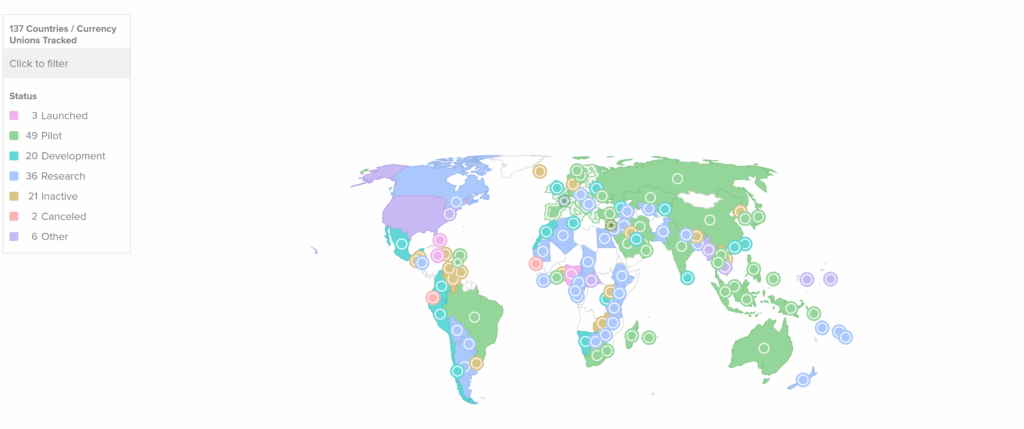

High costs have prompted calls for phased implementation to manage bank capital expenditures. The European Central Bank’s (ECB) timeline includes a 2027 pilot and a full rollout by 2029, with 137 countries exploring central bank digital currencies (CBDCs) that represent 98% of global GDP.

Discover how Italian banks back the ECB digital euro project while addressing cost challenges. Stay ahead in the evolving landscape of central bank digital currencies and explore the implications for Europe’s financial future today.

—

### What is the ECB’s Digital Euro Project?

The ECB’s digital euro project is a central bank digital currency (CBDC) initiative aimed at creating a secure, digital form of the euro for everyday payments. This project seeks to enhance digital sovereignty and complement existing payment systems without replacing cash.

After a two-year preparation period, the project has entered its next phase, focusing on key aspects such as privacy, security, and interoperability with commercial banks.

—

### How Are Italian Banks Responding to the Digital Euro Initiative?

Italian banks, represented by the Italian Banking Association (ABI), have expressed strong support for the ECB’s digital euro project. They view the initiative as essential for maintaining Europe’s digital sovereignty.

Marco Elio Rottigni, ABI’s General Manager, emphasized this during a press seminar in Florence, as reported by Reuters. However, he also highlighted the substantial costs involved and suggested that these expenses be distributed over multiple years to align with banks’ ongoing capital investments.

This position contrasts with concerns from some French and German banks, who worry that an ECB-backed retail wallet might shift deposits away from traditional lenders. In response, Rottigni advocated for a “twin approach” — integrating the digital euro with commercial bank digital currencies to foster innovation.

According to the ECB, over 137 countries and currency unions—accounting for 98% of global GDP—are currently exploring CBDCs, underscoring the global relevance of this project.

European Parliament member Fernando Navarrete, who is leading the review of the proposal, recently drafted a report recommending a scaled-down version of the digital euro. This approach aims to safeguard private systems like Wero, a collaborative payment initiative by 14 European banks. Such measures reflect a balanced push to advance digital payments while protecting the competitive landscape.

—

### Frequently Asked Questions

**What Timeline Has the ECB Set for the Digital Euro Launch?**

The ECB’s Governing Council, at its October 29-30 meeting in Florence, approved advancing the project to the next phase after two years of preparation. A pilot program is slated for 2027, with a full rollout targeted for 2029 — contingent on the adoption of EU legislation in 2026.

This structured approach ensures thorough testing and regulatory alignment before the digital euro goes live.

**Why Do Italian Banks Support the Digital Euro Despite Cost Concerns?**

Italian banks see the digital euro as a critical step toward achieving digital sovereignty in Europe, helping the region stay globally competitive. While implementation costs are high, spreading them out over several years makes the project feasible without straining bank resources. This endorsement highlights Italian banks’ commitment to innovation in central bank digital currencies.

—

### Key Takeaways

– **Strong Endorsement:** Italian banks back the ECB digital euro as a sovereignty measure, differing from reservations voiced in other EU countries.

– **Cost Management:** Spreading implementation expenses over multiple years eases the burden on bank capital, promoting sustainable adoption.

– **Global Context:** With 98% of global GDP represented by countries exploring CBDCs, Europe’s project positions the continent as a leader. Investors should monitor developments closely.

—

### Conclusion

The digital euro ECB project has garnered solid support from Italian banks, who emphasize its crucial role in digital sovereignty while advocating for phased cost implementation to protect the banking sector.

As the ECB progresses toward the 2029 launch—bolstered by technology partnerships enhancing features like offline payments and fraud detection—this initiative promises to modernize Europe’s financial infrastructure.

Stakeholders should prepare for upcoming regulatory shifts to ensure the digital euro fosters trust and efficiency in the rapidly evolving central bank digital currency landscape.

—

### ECB Sets 2029 Target for Digital Euro Launch

The European Central Bank’s Governing Council has outlined a clear path forward for the digital euro, building on an initial two-year preparatory phase. This progression includes extensive testing designed to address technical, legal, and user adoption challenges.

The 2027 pilot will simulate real-world scenarios, gathering vital data on usability and security prior to the anticipated 2029 rollout.

EU legislation, expected in 2026, will provide the necessary legal framework, defining the digital euro’s scope and safeguards.

Fernando Navarrete’s draft report stresses protecting private-sector initiatives like Wero, ensuring that the CBDC complements rather than competes with existing private payment offerings.

Marco Elio Rottigni reinforced the need for Europe to avoid lagging behind global peers by promoting a hybrid model that leverages both public and private innovations.

—

### ECB Signs Deals with Tech Firms for Digital Euro Development

In a significant development, the ECB has secured framework agreements with seven technology providers to bolster the digital euro’s infrastructure.

These partnerships focus on critical areas such as fraud and risk management, secure data exchange, and robust software solutions. Leading firms like Feedzai, experts in fraud detection, and Giesecke+Devrient (G+D), specialists in security technology, are key contributors.

The collaborations will introduce advanced features including:

– **Alias Lookup:** Simplifying transactions without revealing provider details.

– **Offline Payment Options:** Enhancing accessibility for users without internet connectivity.

According to ECB statements, these developments prioritize user privacy and resilience against cyber threats.

This integration of cutting-edge technology underscores the project’s commitment to delivering a reliable, inclusive digital currency that meets modern payment demands.

—

### Final Thoughts

Overall, the digital euro initiative reflects a strategic effort to future-proof Europe’s monetary system.

By addressing stakeholder concerns and leveraging technological innovation, the ECB aims to deliver a CBDC that supports economic stability and drives innovation.

As global CBDC explorations intensify, Europe’s approach could set important benchmarks for other regions, influencing broader financial trends in the years ahead.

Stay informed on this evolving story to understand how the digital euro could reshape the financial landscape both in Europe and globally.

https://bitcoinethereumnews.com/tech/italian-banks-back-ecb-digital-euro-urge-multi-year-cost-spread/