**Josh Sterling Considered for CFTC Chair Amid Growing Crypto Oversight**

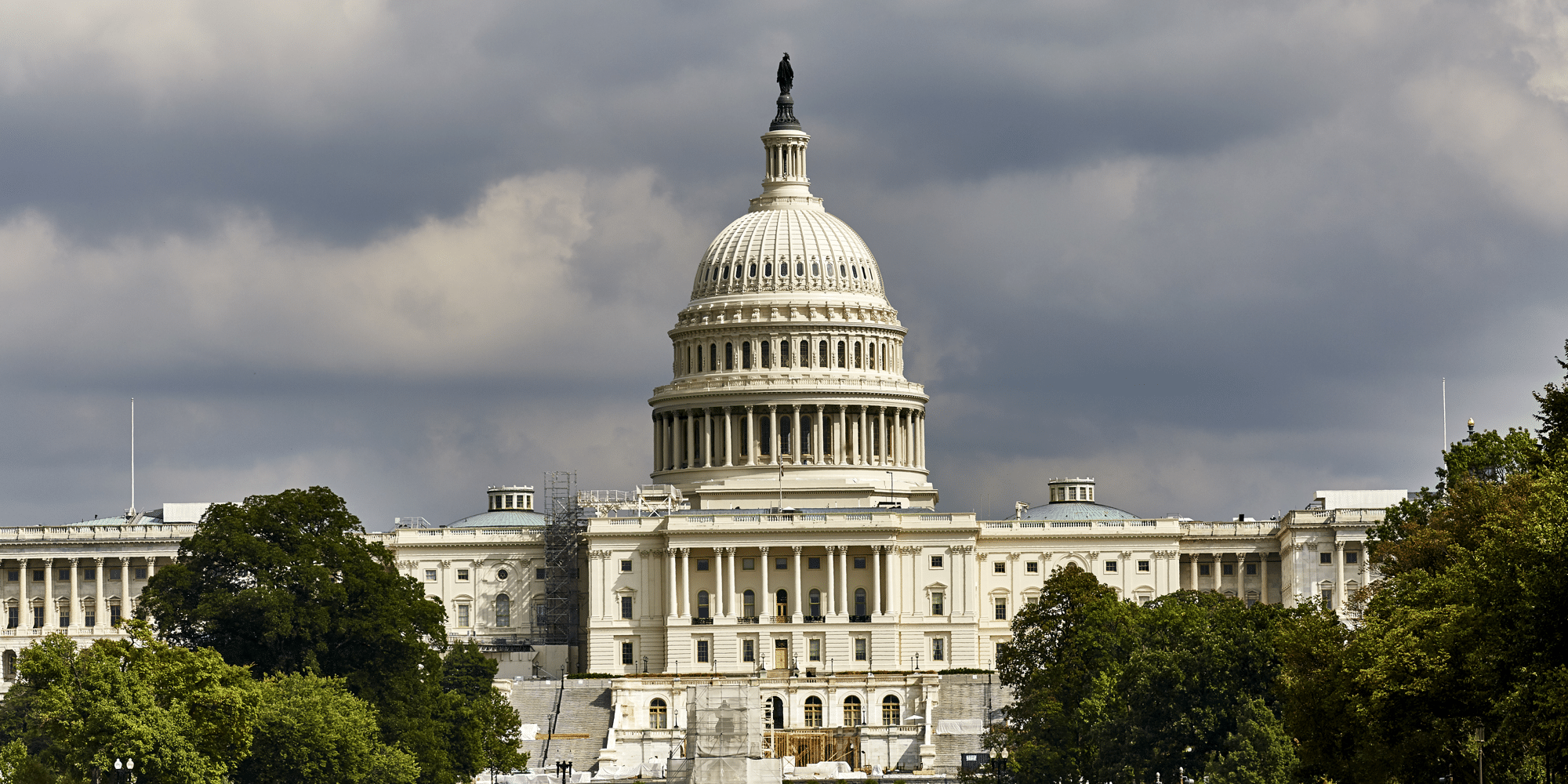

The White House is considering Josh Sterling, a former senior official at the Commodity Futures Trading Commission (CFTC), for the position of chair. This development comes following the stalled nomination of Brian Quintenz, who faced political pushback and conflicts of interest that delayed his confirmation.

Sterling previously served as Director of the CFTC’s Market Participants Division, where he oversaw policies related to market surveillance, registration of participants, and cryptocurrency trading risks. His extensive experience in both traditional financial markets and digital assets positions him as a strong candidate to lead the agency, especially as the CFTC’s role in cryptocurrency regulation continues to expand.

### Expanding Role of the CFTC in Crypto Oversight

Traditionally responsible for regulating derivatives markets—including futures and swaps—the CFTC’s jurisdiction has broadened significantly alongside the growth of the crypto market. Bitcoin and other digital assets are increasingly recognized as commodities, bringing them under the agency’s regulatory umbrella.

The CFTC has taken on a more prominent role in overseeing crypto futures trading, which has sparked ongoing discussions with the Securities and Exchange Commission (SEC) regarding regulatory boundaries between the two agencies. Sterling’s potential appointment as chair would be particularly significant as the CFTC prepares to expand its oversight to include spot trading in digital assets.

Currently, the CFTC is operating with just two commissioners on its five-member panel, a situation that limits the agency’s capacity to effectively enforce regulations. As the cryptocurrency market grows, the CFTC is expected to play a pivotal role in establishing clearer and more effective regulatory frameworks.

### Other Candidates for CFTC Chair

While Sterling is a leading contender, other candidates are also under consideration for the chair position. These include Mike Selig, a former partner at Willkie Farr & Gallagher, and Tyler Williams, a former executive at Galaxy Digital. Both bring significant expertise in digital assets and financial regulation.

However, Sterling’s background in market surveillance and his prior work within the CFTC give him an edge in managing the agency’s expanding role in crypto oversight. The prolonged delay in confirming a permanent chair has complicated the search and contributed to a lack of clear direction on crypto regulation. Industry observers warn that continued delays could hinder progress on critical regulatory initiatives, especially as Congress intensifies efforts to strengthen crypto oversight.

### Strengthening the CFTC’s Crypto Expertise

In addition to the leadership search, the CFTC has been bolstering its advisory committees to enhance expertise in digital assets. The agency recently added new members to its Global Markets Advisory Committee and Digital Asset Markets Subcommittee. These appointments include experts in blockchain infrastructure, legal policy, and institutional crypto strategy, enhancing the agency’s ability to assess risks and coordinate oversight across financial markets.

As Congress debates new cryptocurrency legislation—including the Responsible Financial Innovation Act of 2025—the CFTC’s role in shaping U.S. digital asset regulation is becoming increasingly crucial. If confirmed as chair, Sterling could guide the agency through this transformative period, balancing the need for robust regulatory oversight with the promotion of innovation within the crypto sector.

https://coincentral.com/cftc-chair-role-likely-to-go-to-josh-sterling-as-crypto-regulation-grows/