**Strattec Posts Another Good Quarter, But Is Still Cyclically Expensive**

*November 5, 2025 | 7:20 AM ET*

Strattec Security Corporation (STRT) has reported an impressive 1Q26 performance, marking a record-breaking quarter in both revenues and margins. The company is growing at a healthy pace of 10% year-over-year, with gross margins expanding by nearly 400 basis points. This improvement in profitability has driven a substantial 100% increase in net income, partly fueled by pricing strategies.

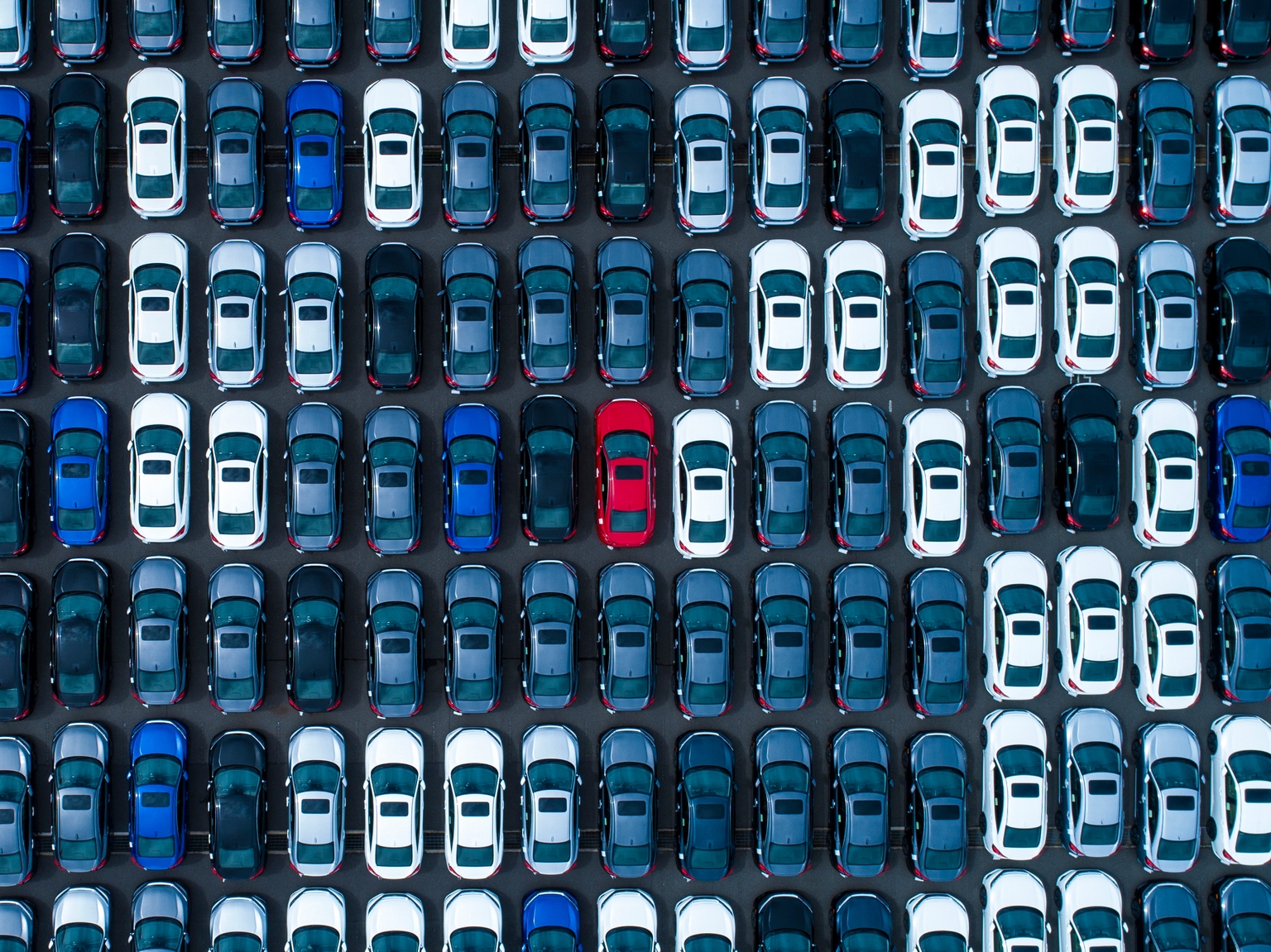

Despite these positive results, Strattec anticipates short-term challenges stemming from ongoing supply chain disruptions affecting the global auto industry, particularly in the United States. Looking further ahead, the primary concern remains the cyclicality of gross margins and how sustainable these recent gains will be over time.

—

### Operational Perspective

Strattec’s recent quarterly results reflect strong operational execution. With revenues and margins both hitting new highs, the company demonstrates solid earning power in a competitive industry. Growing gross margins at this level is notable and highlights the effectiveness of their pricing and cost management strategies.

However, the cyclical nature of the automotive industry and associated supply chains can introduce volatility in future quarters, and investors should be mindful of such dynamics.

—

### About Quipus Capital

This analysis is provided by Quipus Capital, a long-only investment firm focused on evaluating companies from an operational, buy-and-hold perspective. Our approach emphasizes understanding the long-term earnings potential and competitive dynamics of businesses rather than market-driven price fluctuations.

We typically issue hold recommendations, reserving buy calls for only a small fraction of companies at any given time. Our goal is to provide valuable context and cautious insight in a market environment that often leans bullish.

—

### Disclaimer

All opinions expressed in this article are those of the author alone and are provided on an “as is” basis without warranty. This content does not constitute professional investment advice. Readers are encouraged to perform their own due diligence and consult licensed financial professionals before making investment decisions.

The author holds no position in Strattec Security Corporation (STRT) or any related derivatives and does not plan to initiate any within the next 72 hours.

—

### Seeking Alpha Disclosure

Past performance does not guarantee future results. Nothing herein should be construed as investment advice or a recommendation for any security. Views expressed may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed investment adviser or broker.

—

**Recommended For You**

[Related articles and insights]

https://seekingalpha.com/article/4838021-strattec-posts-another-good-quarter-but-is-still-cyclically-expensive?source=feed_all_articles